Take control of your finances today

Everyday Financial Success

Barriers to financial success

In our Money and the Brain course, we discuss common psychological barriers to financial success and how to overcome them. Do a quick review of these concepts.

Budgeting strategies

You are more likely to stick with your budget if you choose a strategy that works well for you.

Pick one of the following methods or combine them to create the perfect fit.

50/30/20

Envelopes

Zero-based budget

Budgeting tools

50/30/20

The 50/30/20 budget

The 50/30/20 budget is great for people who are just getting started. Simply assign a percentage of your income for needs, wants and savings. The 50/30/20 percentages are merely a guideline, so customize your budget to fit your priorities. You can also add categories, such as debt reduction.

Here are some examples:

Review your budget regularly to make sure your spending still aligns with the percentages you set. Many mobile banking services make this easy by using visuals like pie charts to categorize your transactions.

Envelopes

Physical envelopes

Dividing cash into envelopes helps your budget feel more tangible. You can use this method alone or with the 50/30/20 method. When you get paid, divide your cash into envelopes labeled with your monthly expenses. You can create as many envelopes as you'd like. Some people choose to use envelopes only for their variable expenses like gas, groceries and fun money. Others prefer to create envelopes for all of their budget items, including upcoming expenses like car or home maintenance.

Apps like Good Budget can help you plan your digital envelopes.

Digital envelopes

There are some disadvantages of using physical envelopes. You have to get cash each time you get paid and carry money around, which is less secure than storing it in your bank account. Using cash also makes it harder to track your spending. An alternative is to create digital envelopes using secondary savings or debit accounts.

Savings accounts—Create secondary savings accounts labeled with the budget items you want to track. Then, set up automatic transfers to move money to those “envelopes” when you get paid. When you have an expense from one of your categories, transfer money from the secondary account to your checking account to cover it.

Secondary debit accounts—MyExpress debit cards from Mountain America are handy for budget items with a higher potential for overspending, like entertainment, shopping and going out to eat. Visit a branch to open MyExpress accounts for these categories, and then set up automatic transfers on payday into each account for their budgeted amounts. This will allow you to closely track your spending and make adjustments to ensure you meet your goals.

Credit cards—If you want to build credit or earn rewards, you may prefer to use a credit card instead of a debit card. Simply transfer money from your secondary savings accounts to your checking account to pay off your credit card balance weekly, bi-weekly or monthly. To protect your credit score, be sure to keep your credit card balance under 30% of your limit.

Zero-based budget

Zero-based budget

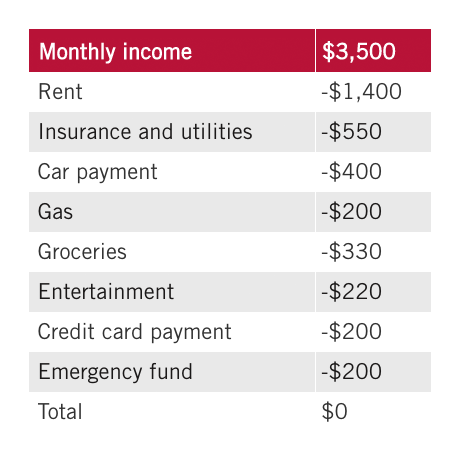

A zero-based budget is great for people who want more control over their finances. You can use it in partnership with the 50/30/20 and envelope methods. The key to this system is assigning every dollar of your income to a spending category. This will help you achieve savings goals, pay down debt and designate money for other goals or causes that are important to you.

The most popular apps for a zero-based budget are Everydollar and You Need a Budget (YNAB).

If you have inconsistent expenses or fluctuating income, track your spending for the past few months to find an average for each budget category. Once you’ve given every dollar a job, review your budget regularly for a few months until you have everything fine-tuned to fit your needs.

Here's an example of a zero-based budget

To avoid dipping into your emergency savings, consider creating a line item in your budget for a slush fund to pay for one-off, unexpected expenses.

Budgeting tools

Pen and paper

Spreadsheet

Financial institution

Apps

Proactive financial planning

Saving for uncertainty

It’s important to plan ahead so you are prepared for uncertain situations instead of allowing them to derail your spending plans and other financial goals. Consider setting up automatic monthly deposits into a secondary savings account for emergencies such as:

- Hospitalizations

- Insurance deductibles

- Home repairs

- Income reduction or loss of employment

- Short-term disability

Saving for financial success

To set yourself up for financial success, avoid using your emergency savings for periodic, expected expenses. Instead, create additional secondary savings accounts for things like:

- Car maintenance and registration

- Home renovations

- Gifts and holiday spending

- Copays for medication and eyewear

- Vacations

- Big-ticket items

Secondary savings accounts make it easy to track progress toward your goals; however, you can also record your savings categories in an Excel spreadsheet or using another method that works for you.

Create savings goals with both an ideal and a last-possible due date to allow for flexibility if your income or expenses change. If you can’t save enough for a goal with a hard deadline, consider ways to reduce expenses or increase income.

Quiz

Next steps

Once you've determined how much you want to set aside for upcoming expenses and unexpected expenses, you'll want to add everything together to make sure your budget is sustainable and use automation to make it easy.

Add it all up

Simple formula: income minus expenses

List your needs first, then use the why, what and how model to guide you as you prioritize your expenses.

Create spending ranges for preference purchases like fast food and entertainment. To do this, set an ideal amount for each spending category, and then budget for a max amount. Throughout the month, focus on hitting that ideal number.

Setting ranges creates flexibility while minimizing spending just because you can if you fall below your limit. It can also help avoid feelings of restriction, so you’re more likely to stick to your spending plan.

Automation

One of the biggest barriers to following a budget is moving money toward your goals. Sometimes you know you should, but you’d rather spend the money elsewhere or you’re just too busy to do it. One of the easiest ways to remove this barrier is to automate your payments toward bills, debt and savings.

Two ways to automate payments are paycheck deductions (set up through your employer via direct deposit) and scheduled transfers. Some people prefer to use both. For example, automatically transfer 10% of your paycheck to emergency savings, and schedule monthly transfers from checking to pay down debt and deposit funds into your secondary savings accounts.

Ways to reduce expenses and increase income

If your expenses exceed your income or if it’s difficult to meet all your obligations, you are not alone. Approximately 42% of employees in the 2021 PWC Employee Financial Wellness survey found it difficult to meet their obligations on time each month. Consider these ideas to decrease your expenses and increase your income.

Reduce expenses

EVALUATE NONESSENTIALS

One of the trickiest parts of budgeting is cutting back on nonessentials because it often becomes an emotional decision. Start by reviewing the why, what and how of our habits and recognize where the emotions are coming from. Are you afraid of missing something? Can you modify a habit to get a similar reward without the cost?

PARE DOWN SUBSCRIPTIONS

Subscriptions can easily eat up your income. Review your account statements regularly to identify subscriptions you are no longer using, and then cancel them.

INSPECT YOUR HABITS

Determine where you can cut back or eliminate spending on things like food, drinks and nicotine to free up some of your income. Understand what reward you’re getting from your habits and look for ways to get a similar reward without the spend.

SET UP EQUAL PAY FOR UTILITIES

Many power, water and gas companies will average your bill so it stays consistent throughout the year. This may not decrease your overall expenses; however, it can help balance out the months when you’re spending more due to changes in the seasons.

GO ON A SPENDING DIET

A spending diet is a commitment to reduce your spending for a period of time so you can achieve your goals. This can be an efficient way to get your budget back on track.

Increase income

PICK UP A SECOND JOB

A second job can boost your income and help you network with people. Some jobs offer same-day pay, making it easy to get money quickly. Use apps like Bacon and TaskRabbit to find odd jobs and pick up shifts for companies that may otherwise outsource to temp agencies.

DO FREELANCE WORK

If you specialize in a particular skill or want to develop a portfolio, freelance work can be a great option. An added benefit is the opportunity to increase your skillset by taking on projects you’re interested in that fall outside the scope of your day job.

SELL PRODUCTS ONLINE

Generate income by selling your art or products from your hobbies (such as prints, stickers and clothing) through platforms like Etsy and Redbubble.

PARTICIPATE IN MARKETING RESEARCH

Many companies are looking for people to try out a product or experience and then provide feedback through apps like dscout.

Resources for assistance

We recognize not everyone has time to take on extra work. If this is the case for you, see if you qualify for assistance through the resources listed below.

Food

- Temporary Assistance for Needy Families (TANF)—food, housing, home energy, childcare and job training assistance

- USDA National Hunger Hotline—1-866-3-HUNGRY or 1-877-8-HAMBRE

Housing

Utilities

- National Energy Assistance Referral—1-866-674-6327

- Lifeline—phone and internet payment assistance

Meet with a financial guide for free

If you would like free financial counseling to help you create a budget, savings plan or strategy to pay down debt, we are here to help! Schedule an appointment today to speak with a financial guide.

Make an appointment