President's Message

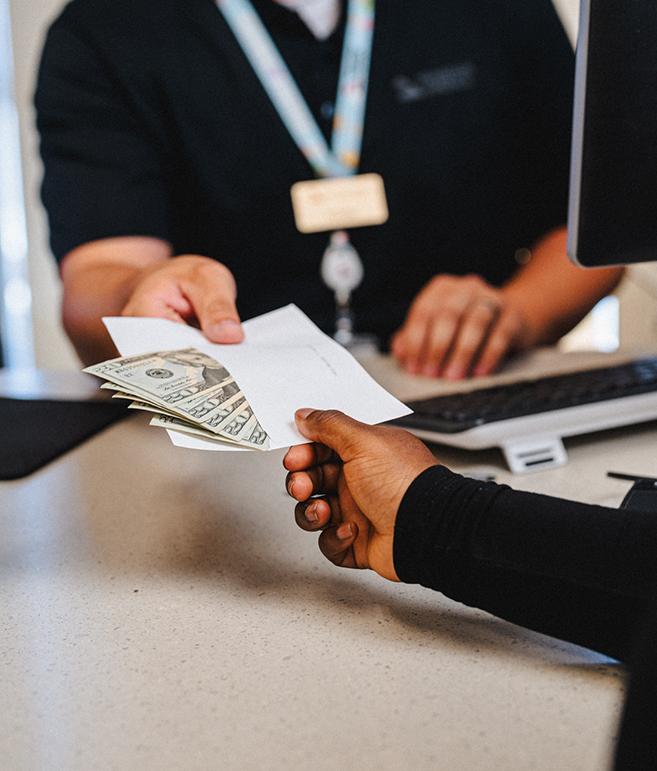

Financial Relief When You Need It Most

If your budget feels tight despite economic indicators, this message is for you. Review practical options to support your financial plan, align income and expenses, and make your money go further—without a complete lifestyle overhaul.

Feature

Think Twice—It Could Be a Scam

“Hi, I’m from the Mountain America fraud team and we just need your username.” Sounds routine, right? Walk through how that line turns into a “send me the code” trick—and discover the easy way to shut it down.

Feature

See Digital Banking in Action

Our quick virtual tour gives you a sense of how the Mountain America digital experience works, what it looks like and why members say it fits their day-to-day routine.

Feature

Activate More Value With MyStyle Checking

Think of your account like your smartphone—powerful, versatile, underused. Take a closer look and see how much more your MyStyle® Checking has in store for you.

Feature

Use Any Card, Win Any Trip

Although summer has ended, your vacation dreams don't have to! Use your Mountain America credit or debit card throughout October and earn entries toward one of two $5,000 vacation vouchers.

PRO TIP

Simplify Your Finances

Never lose a financial document again when you opt in to eStatements. Plus, you'll save paper and reduce clutter.

Get started

Financial Relief When You Need It Most

Sterling Nielsen,

President/CEO

As communities and families face new uncertainties to their safety and security, many of you have also acknowledged the ongoing weight of financial strain. Monthly bills are higher and inflationary pressures have led to rising costs, particularly for groceries, utilities, student loans and insurance. During the past year, three-fifths of the inflation rate has primarily been driven by price changes in housing.*

If you have personally felt this tension, I want you to know that Mountain America understands these pressures and is here to help.

As a member, you have many options to receive trusted support for your finances.

.png)

If you’re feeling the strain, let’s talk. Together, we will find a way to help you save more, spend wisely and breathe a little easier.

Sincerely,

Sterling Nielsen

Think Twice—It Could Be a Scam

Why these tactics work

The pressure to act quickly is a powerful psychological motivator—you don’t want to drag your feet on important matters. Add to that the fear of losing your hard-earned money, and it’s easy to see why some people want to act fast.

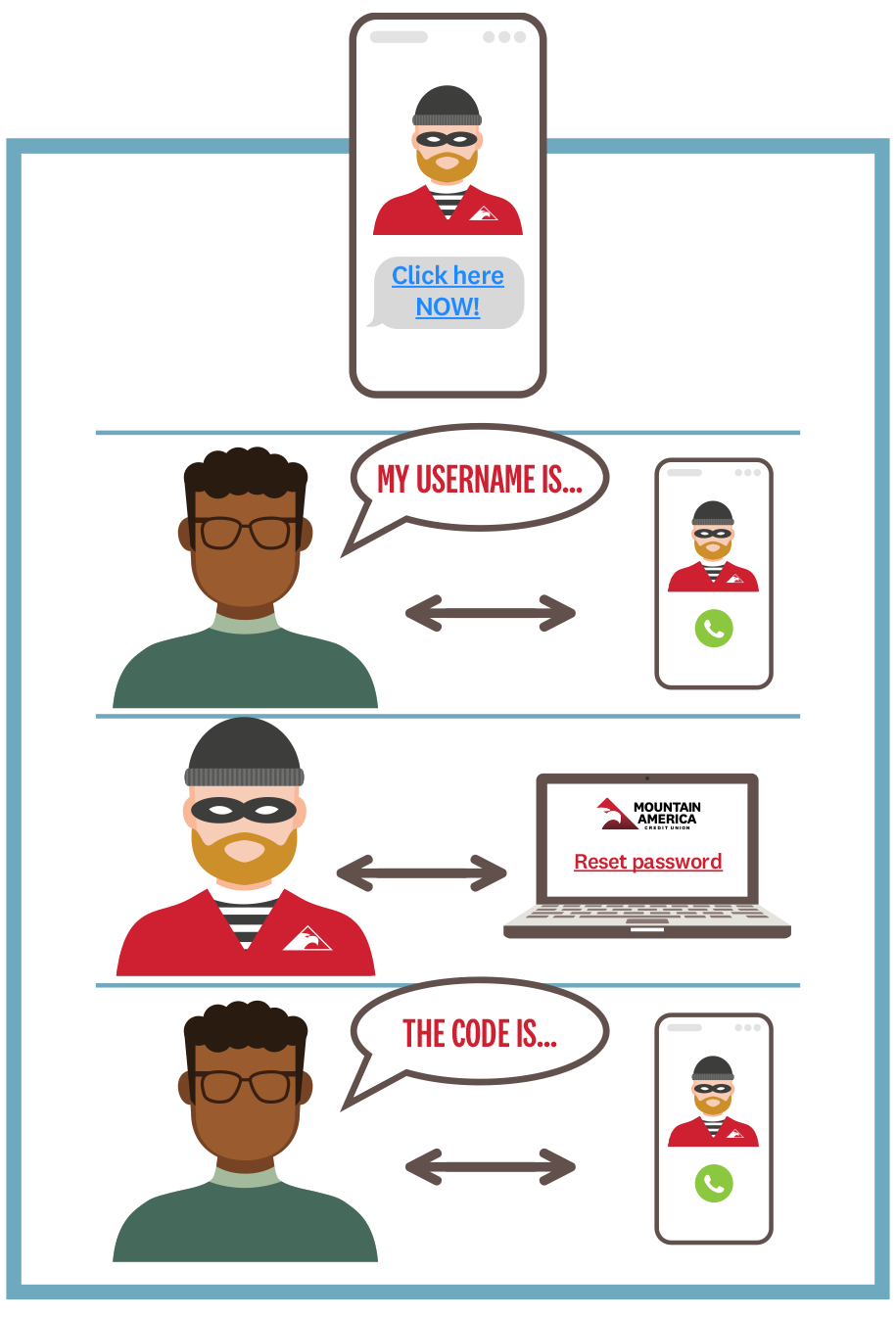

What the scam looks like

If you respond to a phishing text or email, the scammer will call you, spoofing the financial institution’s phone number and saying something like: “Hi, I’m Sam with the fraud department. I need you to verify your online username for security purposes.”

Armed with your username, they can go to the website or app and select the forgot password option. This will send a passcode to your phone.

The fraudster will then say, “I just need to verify one more thing. Please confirm the security code I just sent you.” The scammer now has the information to change your password, take over your account and walk away with your money.

How to protect yourself

While this scenario sounds scary, you can easily avoid scammers’ traps by following these pointers.

- Don’t share your personal information with an unknown caller.

- Make sure the sender’s email address matches their name.

- Hover over links to see if the web address appears suspicious—for example, mntam-cu.com or nnacu.com.

- Don’t download files or click links in unsolicited messages.

- Beware of caller ID—it can be spoofed.

- Your account number.

- Our routing number.

- Credit or debit card PINs.

- Digital banking usernames or passwords.

- Full Social Security numbers.

- The CVV code on the back of your credit or debit card.

- Verification codes.

Please note, we may ask for some of that information if you contact us.

When in doubt, reach out

If you are unsure about a message you receive or you suspect you have been scammed, contact the credit union right away at 1-800-748-4302. We have the financial professionals and tools to help you navigate the situation.

Get more fraud prevention tips

Take a Virtual Tour—See Digital Banking in Action

Trying something new can feel overwhelming, especially when it comes to your money. If you've been curious about mobile and online banking but have concerns about security or simply where to start, we are here to help you.

Take our virtual tour to discover easy ways to bank on the go with Mountain America.

Try our mobile app

Think of our mobile app like a branch in your pocket. Check your balance, transfer money and pay bills without leaving home.

Download

the app

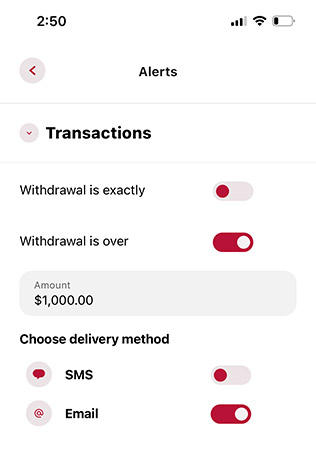

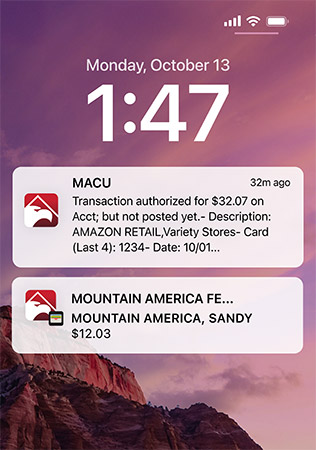

Take control of your account security

Did you know that Mountain America’s digital banking tools meet strict federal security standards? Plus, our customizable security features give you the ability to take a front seat in monitoring your accounts.

Download

the app

Keep tabs on your credit

Your credit score is a key indicator of your financial well-being, so having easy access is essential! Our protected platforms offer you just that at no cost.

Thank you for taking our virtual tour!

Remember, you don't have to dive in all at once. Start by checking your account balance in the app, then gradually explore other features. Our digital tools work alongside your existing banking habits. Need an in-person walk-through of these features? Make a branch appointment for one-on-one help.

Make an appointment

Get the app

on your phone

Activate More Value in Your MyStyle Checking

Ready to use what’s already yours?

Now that you’ve watched, here’s how the most-used benefits can fit into your lifestyle:

- Benefits are available to the primary MyStyle Checking accountholder unless otherwise stated, subject to the terms and conditions for the applicable benefits, which may also include eligibility for family members. Benefits are not available to joint accountholders, trust accounts with an EIN or business accounts.

- Benefit requires no-cost registration/activation. Telehealth services are NOT insurance.

- The descriptions herein are summaries only and do not include all benefit terms, conditions and exclusions. Insurance products are not insured by the NCUA or any federal government agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

- Benefit requires no-cost registration/activation.

- Loan rate discount valid on select new loans only. Loans on approved credit.

Ready to turn your everyday purchases into vacation opportunities?

Through October 31, 2025, Mountain America cardholders can automatically earn entries to win a $5,000 vacation voucher from Get Away Today®.*

Open a new debit or credit card or use your existing card to unlock opportunities to win. Earn entries every time you use your card—whether it’s for gas, groceries or whatever else you need.

Earn entries in the following ways with your debit or credit card

- 50 extra entries when you open a new card

- One entry every time you use your card

- 50 entries for every $500 you spend

- 50 extra entries for every Mountain America card you add to a mobile wallet

- Use our push to wallet feature to effortlessly add your card to Apple Pay® or Google Pay™

Photograph © Carolyn Johnson (Sawtooth National Forest, ID) | 2025 Calendar Contest Winner, October