ATV financing for smooth trails ahead

New & Used ATV Loans

Start your off-road adventure on the right track with low-rate ATV financing from Mountain America Credit Union.

Calculate your ATV loan payment¹

Today's Rate

New & Used ATV Loans

As low as

Easy ATV financing

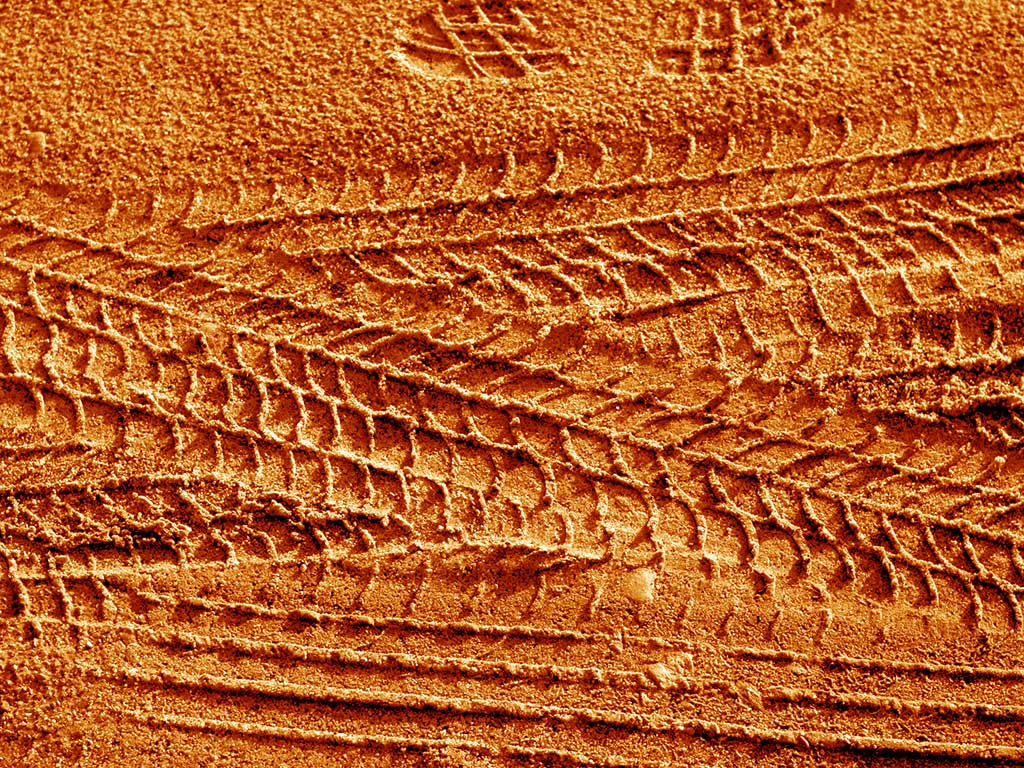

If you have always fantasized about cruising colorful desertscapes on an ATV or soaring down the coastal highway on a motorcycle, then why not make that dream a reality? Mountain America offers low, fixed ATV loan rates, so you can hit the trails without breaking the bank.Our ATV loans feature:

- Fixed interest rates as low as % APR

- No application fees

- ATV loan terms up to 72 months (6 years)³

- Onsite financing at many dealerships

- Rate discounts with MyStyle® Checking⁴

ATV loan FAQs

How do ATV loans work?

ATV financing is similar to financing a car or motorhome. You’ll get a loan term, from 12 to 72 months, where you pay off the cost of your ATV in monthly installments, plus interest and any fees. When you consider financing an ATV or motorcycle, take advantage of Mountain America's flexible lending period, as long as 72 months (or 6 years).³ So, when calculating the monthly note for a motorcycle or ATV, factor in:

- The total cost of the vehicle

- The monthly fixed interest rate—loan calculators can help you crunch the numbers (generally, the higher your credit score, the lower the interest rates on your purchase will be)

- Divide those totals by the number of months you wish to finance

Even if you are more comfortable making the terms on a recreational vehicle for a long period of time, as long as you have a low fixed interest rate, you are still paying more on the premium than in interest. Further, there are no penalties for paying above the minimum amount due, which could help reduce the amount paid in interest.

How long can you finance an ATV?

Banks and credit unions offer conventional ATV loans for fixed periods of time, typically between 3–6 years, with fixed annual percentage rates. The APR will depend on your credit score, the loan term, ATV cost and the organization that is financing the loan.

Some financial institutions may also offer revolving loans. These loans are often easier to qualify for and have lower monthly payments. However, a lower payment means it takes much longer to begin paying down the principal on the loan. Additionally, a variable interest rate may mean your rate could go up or down during the loan period.

This is why conventional loans tend to make better financial sense for ATV owners, because the interest rate is locked in for the duration of their loan term and the owner knows when they’ll pay it off.

Start your adventure today

Apply today for your new or used ATV loan online by clicking the button below. Or, apply at a local branch.You can even ask for Mountain America financing at the dealership.

Apply now

Additional resources

PowerSports Protection

Make sure your ATV repairs are covered with an affordable vehicle protection plan.

Before You Buy

Do your homework before you buy your next car or ATV. Our free e-book gives you tips to get the best deal.

8 Car-Buying Blunders

Avoid buyer's remorse! Watch out for these common pitfalls when purchasing a vehicle.

- Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regard to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

- Loan rate discount valid on new loans only.