Protect yourself and loved ones from fraud

Senior Scams

Common scams targeting seniors

According to the Senate Special Committee on Aging, seniors lost approximately $3 billion to scams in 2020. Scammers use many channels, including phone calls, text messages, emails, voicemail and social media sites. Watch out for these common tactics:

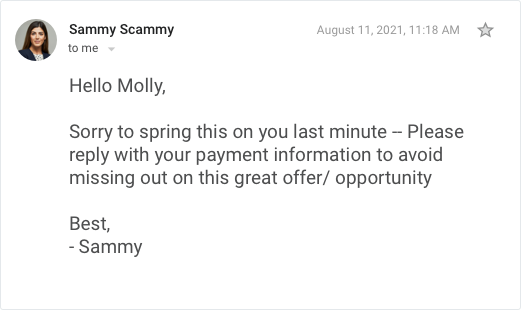

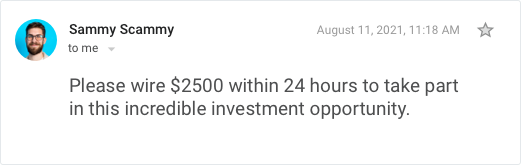

Claims of urgency (emergencies, limited-time offers, etc.)

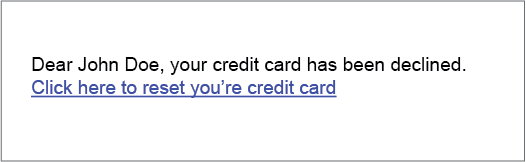

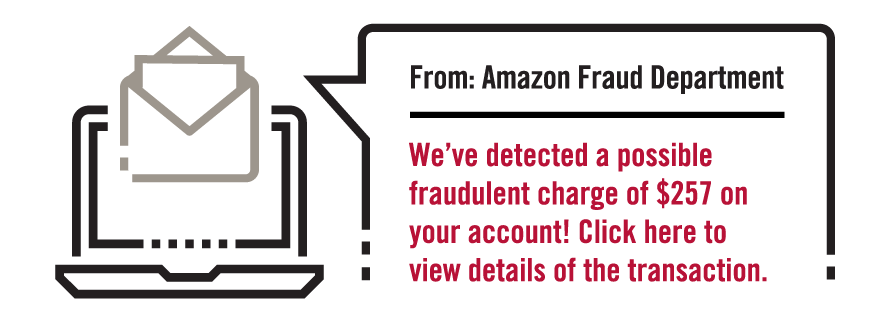

Unsolicited calls or emails from seemingly legitimate organizations

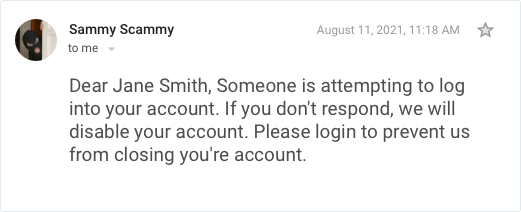

Claims of a problem with your account

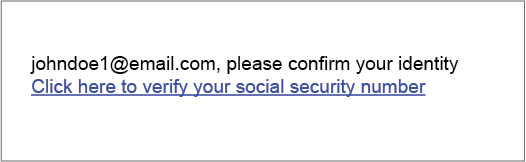

Requests to update or confirm account or payment information

Unexpected notifications of refunds, winnings or free trips

Requests for wire transfers, online payments, money orders, gift cards and prepaid debit cards

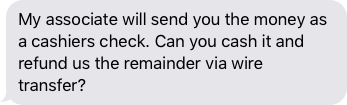

Offers to send you money, requesting you use a different method to return the funds or send the money on to someone else

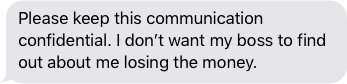

Requests to keep the relationship or transaction confidential

Threats of harm or arrest toward you or your family

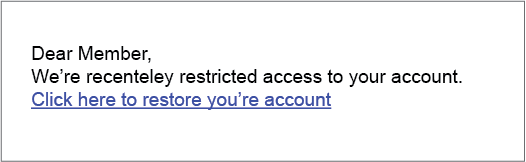

Use of incorrect punctuation, spelling and grammar

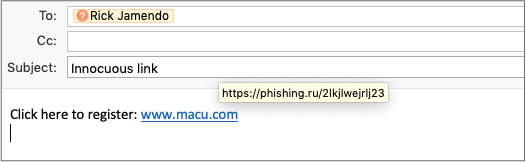

Information (emails, phone numbers, etc.) that doesn’t match the company’s official website

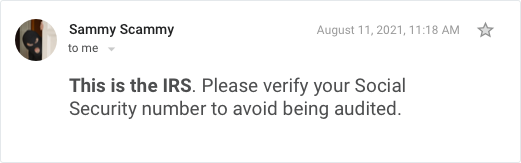

Unexpected calls from government entities with requests for personal information

Offers that are too good to be true

Impersonation and phishing scams

Someone contacts you claiming to be a relative in need or a seemingly legitimate organization.

IRS

A fraudster claims you owe the IRS back taxes or penalties and asks you to send a payment via wire transfer or prepaid gift/debit cards. They demand immediate payment and threaten actions such as home foreclosure or arrest.

Social Security

The scammer claims they are calling from the Social Security Administration and asks for identifying information such as your Social Security or bank account number.

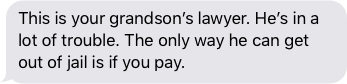

Relative

The scammer poses as a loved one in an emergency situation (hospital, jail, etc.). They will usually ask you to keep the incident a secret and send money, often through wire transfer or gift cards, as soon as possible.

Telemarketer

Someone contacts you posing as a legitimate business offering services, loans, free trips or help with account management. They may also attempt to collect on debts they claim you owe. They'll ask for information about you and your accounts, as well as payments in the form of wire transfers and prepaid gift cards.

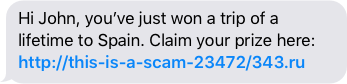

Phishing

Scammers posing as legitimate organizations will contact you through email and text message, directing you to a counterfeit website where you are instructed to enter/update your personal information or payment details.

Sensational Scams

A fraudster uses the lure of wealth, a common interest or an online dating relationship to trick you into sending them money.

See the boxes below to learn more.

Romance scam

Scammers use dating apps, email and social media to cultivate a relationship with you, then pretend to need money for things like medical care or travel expenses to visit you. They may also try to trick you into laundering their money, asking you to complete transactions such as cashing checks and forwarding packages.

Sweepstakes and lottery scam

Someone notifies you that you have won a lottery or sweepstakes, often taking place in another country. The scammer asks for payment to cover fees or taxes before you can collect your winnings.

Investment scam

A fraudster approaches you with a high-potential, risk-free investment opportunity. They make guarantees of financial gain and pressure you to act quickly on a limited-time opportunity. They may ask for a management fee or down payment, they then disappear after receiving the money.

Affinity fraud

Someone acting as a member of a religious or community organization targets influencers to share the scheme and convince others of its legitimacy and value.

Products and services scams

Someone offers you a product or service in order to mine your personal data or overcharge you, often without delivering what they promised.

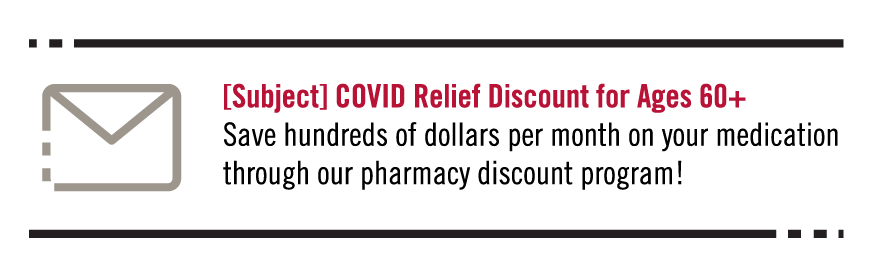

Counterfeit prescription drugs

Illegitimate pharmacies advertise expired, toxic or counterfeit medication. They may direct you to a website asking for your credit card information, then take the money you authorized without delievering the product or use your card number for unauthorized purchases.

Health insurance scam

Fake insurance companies sell comprehensive insurance plans, collecting the premium without paying the claims. They may also offer a discount on medical services without actually paying for your health care.

Home repair fraud

A scammer comes to your house offering home improvement services or add-ons such as solar panels. They will pressure you with limited-time offers, asking you to pay with cash or offering to apply for financing on your behalf.

Tips to protect yourself

- Don't trust Caller ID. Scammers can spoof phone numbers.

- Avoid giving personal information over the phone.

- Don't download files or click links in unsolicited texts, emails or social media messages.

- Consult with trusted family and friends before making big financial decisions.

- Add your phone number to the National Do Not Call Registry.

- Get a copy of your credit report through annualcreditreport.com and monitor your accounts regularly.

- Thoroughly research people, organizations and their claims. Look up phone numbers and online reviews about organizations, use reverse image search for people you meet online, and read all contracts and agreements before signing. To use reverse image search, click the camera icon in the search bar to copy/paste the URL or upload the image.

- Avoid situations where you are asked to forward money or packages.

- Report scams to the Federal Trade Commission.