How to get the most out of your HELOC

HELOC

Everything You Need to Know About HELOCs

What is a HELOC?

If you don’t have the cash and don’t want to use a credit card, and you own your home, hope isn’t lost.

Home Equity Line of Credit

HELOC stands for home equity line of credit. And it works like how it sounds. You receive a revolving line of credit, and the lender uses the available equity on your home as collateral. Think of it as a credit card. You’re given a maximum amount of money as a line of credit that you can take out as you need it, and then as you pay back your outstanding balance, your line of credit is replenished and available for additional use.

How can you use a HELOC?

Some of the more common reasons to get a HELOC include:

- Home improvements

- Landscaping

- Debt consolidation

- Emergency cash availability

- College expenses

- Vehicle purchase

- Medical expenses

- Start-up business expenditure

Requirements for getting a HELOC

Requirements to qualify for a HELOC vary by lender, but generally here’s what you can expect.

Low Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your monthly income that goes toward paying off your debts. The percentage range varies by lender, but expect to only be approved with a DTI ratio of 45% or less. Lenders want to make sure you can really afford to borrow more money while keeping up with your previous obligations, so the lower the DTI, the better.

To figure your DTI, add up all your monthly payments. This includes things like your mortgage principal and interest, taxes, homeowners insurance, car loan, child support and any other debt you’re legally responsible to pay. Divide this total by your monthly gross income.

Good or Excellent Credit Score

While qualifying for a HELOC is more dependent on your home equity than your credit score, good or excellent credit makes it easier to qualify. A good average to shoot for is 620 or higher. Plus, the better your credit score, the better your interest rate.

If your credit score is lower, don't worry. Mountain America is here to support your financial success, whether that is through improving your credit or exploring alternative loan types. Regardless of your circumstance, meeting with a financial expert can help you make plans to build your home equity and reach your goals. Schedule a consultation today to meet with a loan officer.

Home Equity

Your available home equity is your current loan balance divided by the current appraised value of your home. This number is called your loan-to-value ratio (LTV). With a HELOC, you'll likely need to figure out your combined loan-to-value ratio (CLTV). You get this number by adding how much you want to borrow (line of credit amount) with how much you owe on your home and then dividing that total by the current appraised value of your home. Most lenders require a CLTV of up to 85%.

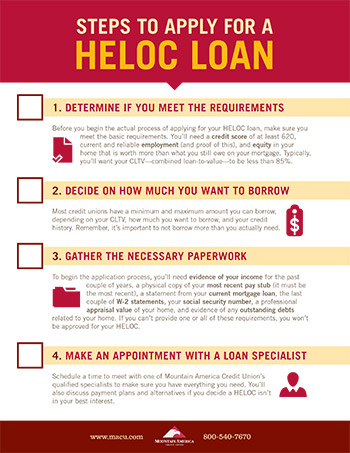

What do you need to apply for a HELOC?

Applying for a HELOC is similar to applying for a traditional mortgage. Here's what you'll need.

What do you need to apply for a HELOC?

Applying for a HELOC is similar to applying for a traditional mortgage. Once you choose a HELOC lender, you’ll fill out a loan application online, in person or over the phone. Expect to provide the following documentation and information:

- Proper identification

- Contact information

- Proof of employment and income

- Documents for certain life events, i.e. child support, alimony, etc.

- Proof of home ownership

- Homeowners insurance

- Enough equity in the home to meet the loan to value requirement.

Other information may be required depending on the lender and your specific circumstance.

Using a HELOC

A HELOC is a great financial tool for homeowners—but only when you’re smart with how you use and pay it off.

When You Should Use a HELOC

Use the equity in your home to make improvements in your life that make sense with your long-term plans and for things that either retain their value or provide a bigger return on your investment, such as:

- Home renovations

- Landscaping

- College education costs

- Medical expenses

- Vehicle purchase

- Property investment

- Start-up business expenditure

- Debt consolidation

When You Shouldn't Get a HELOC

Since your house is collateral, it's recommended to not use a HELOC to pay for things that don't retain their value or offer any long-term return. Here are some things you don't want to use a HELOC for:

- Investing in the stock market

- Vacations

- New entertainment system

- New wardrobe

HELOC vs. Home Equity Loan

Some people think a HELOC is the same as a home equity loan—it's not.

| HELOC | Home Equity Loan | |

|---|---|---|

| What is it? | ||

| What is it? | A line of credit where the lender uses the equity of your home as collateral. | A lump-sum loan you get where your home’s equity is used as collateral. |

| How does it work? | ||

| How does it work? | It’s flexible like a credit card. You have a maximum amount, and you can use up to the maximum amount as you need. You also pay interest on what you take out. | It’s like a second mortgage. You receive a lump sum of money, and then you start immediately paying it back with monthly installments that include your principal and interest. |

| Benefits | ||

| Benefits |

|

|

| Considerations | ||

| Considerations |

|

|

Tips and tricks to get the most out of a HELOC

- Don’t withdraw more than you need.

- Understand how a HELOC works and how much it will cost you. Read the fine print, know any conditions and be aware of any upfront costs, closing costs or yearly fees.

- Make payments on the principal during the draw period to reduce the amount of interest paid.

- Have a good credit score and a good loan-to-value ratio by having enough equity in your home to get the best rate.

- Determine your payback plan, set a budget and stick to it.

Is a HELOC right for you?

If you’re wanting to take out a HELOC consider:

- What you can afford

- What you plan to use it for

- If you can get approved

- If you’re disciplined enough to stick to a budget and you have a plan to pay it back.

Learn more

A home equity line of credit can be a great financial tool for homeowners. Learn more about getting the most from your HELOC.

Keep reading