Teach Your Kids About Credit

Money and credit management can be a bit of a balancing act. For kids, it can be even more confusing.

When should I teach my child about money?

Start teaching kids about money when they are toddlers. At this young age, explain what money is and the basics of saving and spending. Get your child a piggy bank to save all that birthday and holiday money. Take them to the bank or credit union with you so they can see how transactions are done. During the elementary school years, focus on the correlation between work and money, the financial responsibility of buy and saving and the difference between needs and wants. The teenage years are the time to get a bit more sophisticated and prepare you children for the financial skills they will need as adults. Talk to them about loans, interest, investments, checking accounts, debit cards, savings accounts and credit cards. Invite them to join some of your everyday family financial discussions to see how decisions are made. And get them a debit card so they can see their money in action.

Ultimately, you’re the parent. You know your child best—you’ll know when they’re ready to talk more about money and financial independence.

How do I teach my child financial responsibility?

How you teach your child will depend on how they learn best. If you have a visual child, use a clear jar for them to save money they earn. If they’re logical, when they see something on TV they want, pull out the old pen and paper. Create a budget to show them how they could save to get it. If they are ready to commit, take them to the bank or credit union and set up an account. Set up regular check-ins to monitor their progress and continue to educate them about responsible money management. Let them make their own buying and saving choices. If they make a bad choice, use it as a lesson to make a better one in the future.

The best way you can teach your kids about financial responsibility is to set a good example yourself and to share the knowledge often.

Teaching Kids About Credit

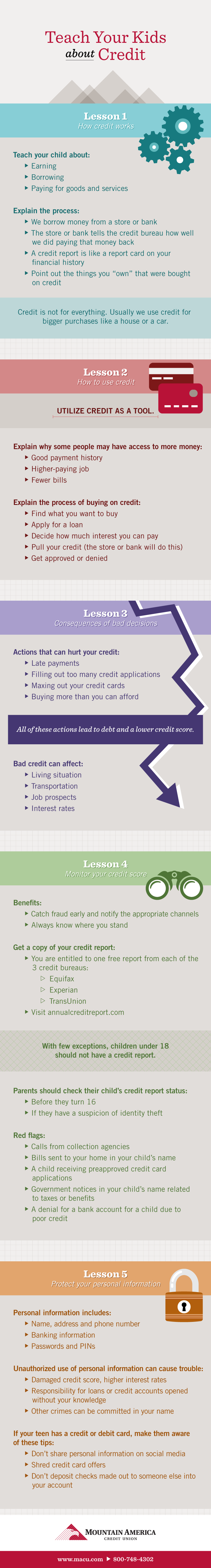

How much do your kids know about credit? Often, the only instruction they receive is a quick download with their first credit card. A better way may be to ease them into it—teach them the necessary skills and reinforce those skills over time. Start with basic concepts of credit and them move to more advanced ideas as they mature and gain understanding.

In the graphic below, you’ll find five short as easy lessons about credit. These lessons are great starting points for teaching credit card best practices and financial responsibility. No matter your child’s age, you can guide each topic in a way they’ll understand.

Related Articles

The Right Age to Start Building Credit