Earthquake Insurance: Are You Covered or on Shaky Ground?

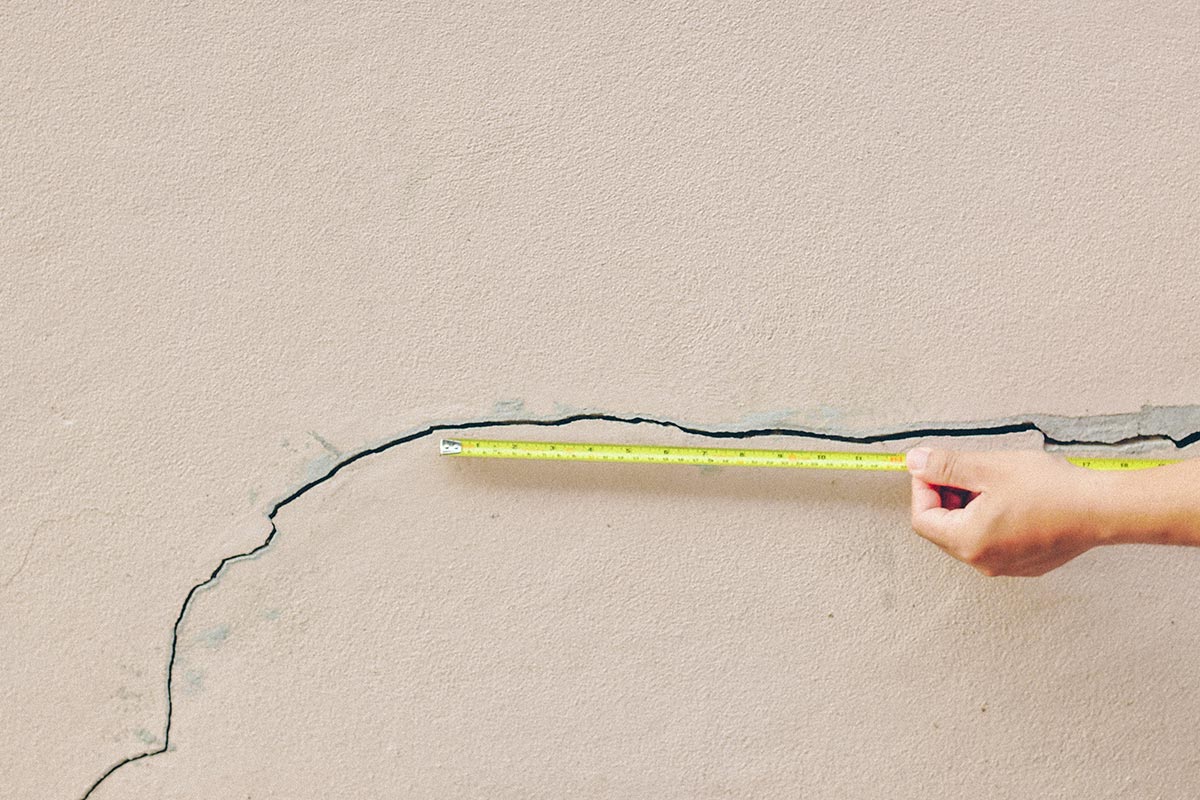

Impossible to predict, earthquakes can cause major damage to your personal property and home. It’s a common assumption that homeowners insurance covers earthquakes and other natural disasters, but this isn’t always the case.

What you should know about earthquake insurance

-

Damage from earthquakes is not covered by a standard homeowners policy. Like flood insurance, earthquake insurance must be purchased separately.

-

Earthquake coverage can be added as an endorsement on your homeowners policy or purchased as a separate policy.

-

Many insurance companies have specific enrollment periods for earthquake coverage. If you choose not to add the coverage when you purchase a homeowners policy, you may need to wait until your policy renews to add it.

-

If the insurance company has specific enrollment periods for earthquake coverage, you may receive an offer for the coverage with your renewal policy. This coverage is typically offered every other year.

Who could benefit from having earthquake insurance?

The recent earthquakes in Utah and Idaho may have you thinking more seriously about how to protect your possessions in just such a disaster.

If you own your home and have a typical mortgage and deed of trust, you will be responsible for the loan balance even if your home is damaged or destroyed by an earthquake. If you live near a fault or have experienced recent seismic activity nearby, you may want to consider this additional coverage to protect your investment as well as your personal property.

As a renter, earthquake insurance is excluded from standard renter insurance policies. However, standalone earthquake insurance can be added to your policy, or you can opt for an earthquake endorsement to cover personal property damaged by an earthquake.

The deductible, amount of coverage available and cost can vary by state. Meet with an insurance professional to get the details for your area.

How can earthquake coverage help?

Earthquake coverage can help you get back on track after sustaining damage from an earthquake. Here are a few things a policy may cover:

-

Repairs to your house and attached structures—such as a garage, shed or guest house.

-

Repairs to or replacement of your personal belongings—like furniture, clothes or electronics.

-

Additional living expenses—like a hotel—if you can’t live in your home.

-

Paying the bill for a mortgage, second mortgage or line of credit if your home is destroyed.

However, it may not cover these:

-

Fires caused by an earthquake. This should be covered under your homeowners insurance.

-

Vehicle damage. Check your auto policy to make sure you have coverage via comprehensive auto insurance.

-

Damage due to flood. You’ll need a separate flood insurance policy for this one.

-

Sinkholes—some states require insurers to offer sinkhole insurance. You may be able to add it to your homeowners insurance or get separate coverage.

-

Masonry, such as the brick, stone or rock used for your home’s veneer—this can be covered with add-on coverage.

How much does earthquake insurance cost?

In Utah and Idaho, earthquake insurance is excluded from a standard homeowners policy unless endorsed. And not all homes qualify for earthquake insurance due to proximity of the home to an active fault line or other factors.

Factors impacting rate and eligibility may include dwelling coverage, deductible, age of home, style, number of stories, foundation and exterior wall covering. Unlike a typical homeowners policy, the deductible is a percentage of the dwelling coverage, ranging from 5% to 25%, depending on the insurance carrier and coverage selected.

Availability of earthquake coverage is limited in states with active fault lines and may not be available as an endorsement on the homeowners policy. However, a separate catastrophe policy may be an option to supplement the homeowners policy. Also, carriers may restrict issuing new earthquake coverage after a recent earthquake. For information on how much insurance costs in your state, check with your provider.

How to reduce damages and risk of injury

Earthquakes can cause devastation at any time and without warning. Taking steps to secure the furnishings in your home may help prevent injuries and mitigate damages should an earthquake occur.

Here are some steps to protect your family and your home:

-

Secure bookcases and shelving units to prevent them from toppling over and causing injury or damage.

-

Attach cabinets to the walls and floors to prevent them from falling over and to keep their contents safe.

-

Securely anchor large appliances to the wall and add a brace to your water heater.

-

Consider using shatter-resistant Teflon fluorescent lights or install plastic sleeves over the light tubes to keep glass from scattering if broken.

-

Secure heavy equipment such as televisions and computers to the furniture on which they are placed or the wall behind them.

-

Use closed screw eyes instead of traditional picture hangers to secure pictures and other valuable artwork to the walls.

To discuss the right solution for your needs, please reach out to your insurance professional.

Related Articles

How Much Homeowners Insurance Do I Need?

Checklist: Demystify Your Auto Insurance