Why Is the Cost of My Home and Auto Insurance Increasing?

There are many reasons why you may be seeing an increase in your insurance premiums. Get the scoop here and then review your policy with a professional.

Even with proper home maintenance and a clean driving record, drivers and homeowners may be seeing an increase in their insurance rates. There are many factors that affect the cost of insurance. In this article, we’ll discuss why rates are increasing and how you can keep your insurance premiums affordable.

Price increases for homeowners

In a recent survey by SafeHome.org, 43% of homeowners indicated their insurance premiums have increased in the past year, rising to an average of $1,584. Let’s take a look at why.

Claims

If you file a claim on your home insurance, this may cause your premium to increase temporarily. The amount your premium increases after filing a claim will depend on:

- Your personal claims history.

- Type of claim.

- Degree of damage.

- Where you live.

Loss of discounts

There are a variety of discounts you can apply to help bring down your rate. If you are seeing an increase in your insurance premium, here are a few discounts you can verify are in effect.

- Advance quote discount. This discount can be applied to your policy when you first purchase insurance and is typically reduced/removed over time.

- New roof credits. As the roof on your home ages, this discount will start to decrease each year at renewal. If you have recently replaced your roof, let your insurance agent know so this discount can be renewed on your policy.

- Newer home discount. As your home ages, this discount will decrease each year at renewal. If you have made recent updates to your home (e.g., electrical, plumbing, heating), talk with your insurance agent about discounts for these upgrades.

- Claims-free discount. The longer you go without filing a claim on your homeowners policy, the more you will save with a claims-free discount. Most insurers will apply this discount after you have been claims-free for three to five years. If you file a claim, this discount will no longer apply until sufficient time has passed.

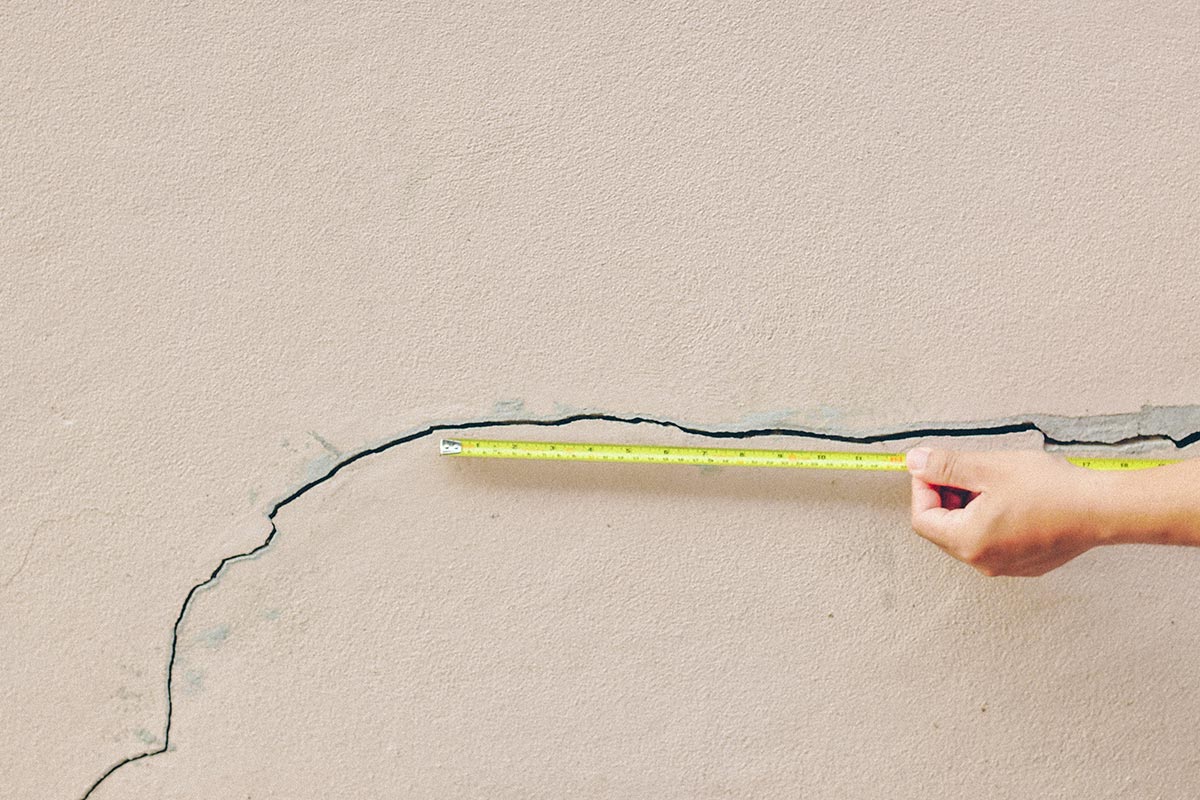

Increased reconstruction costs

Due to supply chain issues, construction labor shortages, and record-high inflation over the past few years, the cost of repairing and rebuilding homes has increased substantially. Even though some of these issues have been resolved, home values have stayed higher which has had a direct effect on the cost of homeowners insurance. The higher the replacement cost of the home, the higher the cost of the insurance.

With increased construction costs, do you have the right amount of coverage on your homeowners insurance? Find out more.

Increase in natural weather disasters

Over the last few years, the home insurance industry has experienced record-setting claim payouts and financial losses due to a higher occurrence of more extreme natural disasters. These disasters include hurricanes, tornadoes, wildfires, flooding and other severe weather. In 2022, there were 18 separate billion-dollar natural disasters in the United States—costing a total of $165 billion.*

The increase in costly natural disaster events, combined with increasing construction costs, is triggering increases in the cost of homeowners insurance.

Price increases for drivers

Price increases on auto insurance are affecting many drivers. Some factors that affect auto insurance rates are specific to your policy (e.g., driving violations, claims, young drivers on your policy, type and age of vehicles you drive, etc.), while other factors—inflation, parts and labor shortages, and an overall increase in accidents—are affecting the majority of the industry.

Driving violations

Just one driving violation can increase the cost of your auto insurance by an average of 35%. Even seemingly minor infractions can be costly as well, with a speeding ticket adding an average $422 per year to your insurance. It varies by state, but most driving violations will be added to your record, and insurance companies have access to this information. A violation can be used to justify an increase to your monthly bill, and your insurance company may choose not to renew your policy when it expires if you have several serious violations on your record.

Claims

An accident can be even worse for your insurance rate than a driving violation. While most insurance companies will raise your rate after an at-fault accident, the amount can vary based on your insurance company, the state you live in, and the damage caused in the accident.

Adding young drivers to your policy

Teenage drivers cost more to insure as they have a higher rate of accidents and file more claims compared to the average driver. According to the Insurance Information Institute, adding a teenage driver to your insurance policy can increase the insurance costs anywhere between 50 to 100%.

Keeping teens and young adults’ attention focused on driving while setting clear priorities on how to eliminate distractions can positively impact their safety. Take time today to talk with your teens and remember to lead by example.

Adding newer/more expensive vehicles to your policy

Newer vehicles have more advanced technology, such as backup cameras and blind spot detection sensors, that are more costly to repair or replace. These sensors are easily damaged and require a trained technician and specialized tools to replace. This has led to an increase in repair and replacement costs, even for something as simple as a bumper or windshield.

Increase in accident frequency

The number of drivers on the road is returning to pre-pandemic levels. This increase in traffic coupled with reckless behavior—drug and alcohol use, excessive speeding, distracted driving, and lack of seatbelt use—is leading to a rise in accident frequency, resulting in an overall increase in insurance rates across the industry.

How you can lower your insurance costs

There are a variety of things you can do to help lower your insurance costs and mitigate risk.

Tips for lowering your homeowners insurance premium

- Maintain a good credit history. Your credit information is taken into consideration when insurers price homeowners insurance policies.

- Raise your deductible. Increasing your deductible from $500 to $1,000 could save you up to 25% on your insurance premium.

- Insure your home and auto with the same insurance company to take advantage of multi-policy discounts.

- Review your coverage on an annual basis. Are there items you’ve been paying to insure that have depreciated in value or that you no longer own?

- Properly maintain your home so it is more disaster resistant, including creating defensible space, preventing water damage, and guarding against theft and intrusion.

Tips for lowering your auto insurance costs

- Consider a higher deductible to lower your premium.

- Research insurance costs before you buy a new or used vehicle. If you know what to expect on cost, this will help guide you in purchasing a vehicle with an affordable insurance rate.

- Ask your insurance agent about available discounts. Discounts are available for such things as multi-policy, good driver, good student, low mileage and certain safety features.

- Maintain a good credit history. Your credit score is a key factor in the rate you pay for auto insurance.

- Practice behaviors that decrease your risk, including practicing defensive driving techniques and avoiding distracted driving.

We recommend reviewing your insurance annually with your agent to get the coverage that will best fit your needs. They’ll help you understand your policy, assess the rapidly changing replacement cost of your home, and ensure any available discounts are being applied to your policy.

*climate.gov

Related Articles

How Much Homeowners Insurance Do I Need?