Your Guide to Creating a Successful Retirement Strategy

Looking for something fun to do this weekend? Might we suggest a little bit of good, old-fashioned retirement planning?

Ok, you don't need to spend your Saturday night crunching numbers and worrying about 401(k)s—you probably wouldn't be able to get hold of your HR department anyway! But you should be at least thinking about saving for retirement and creating a long-term strategy to achieve your individual goals.

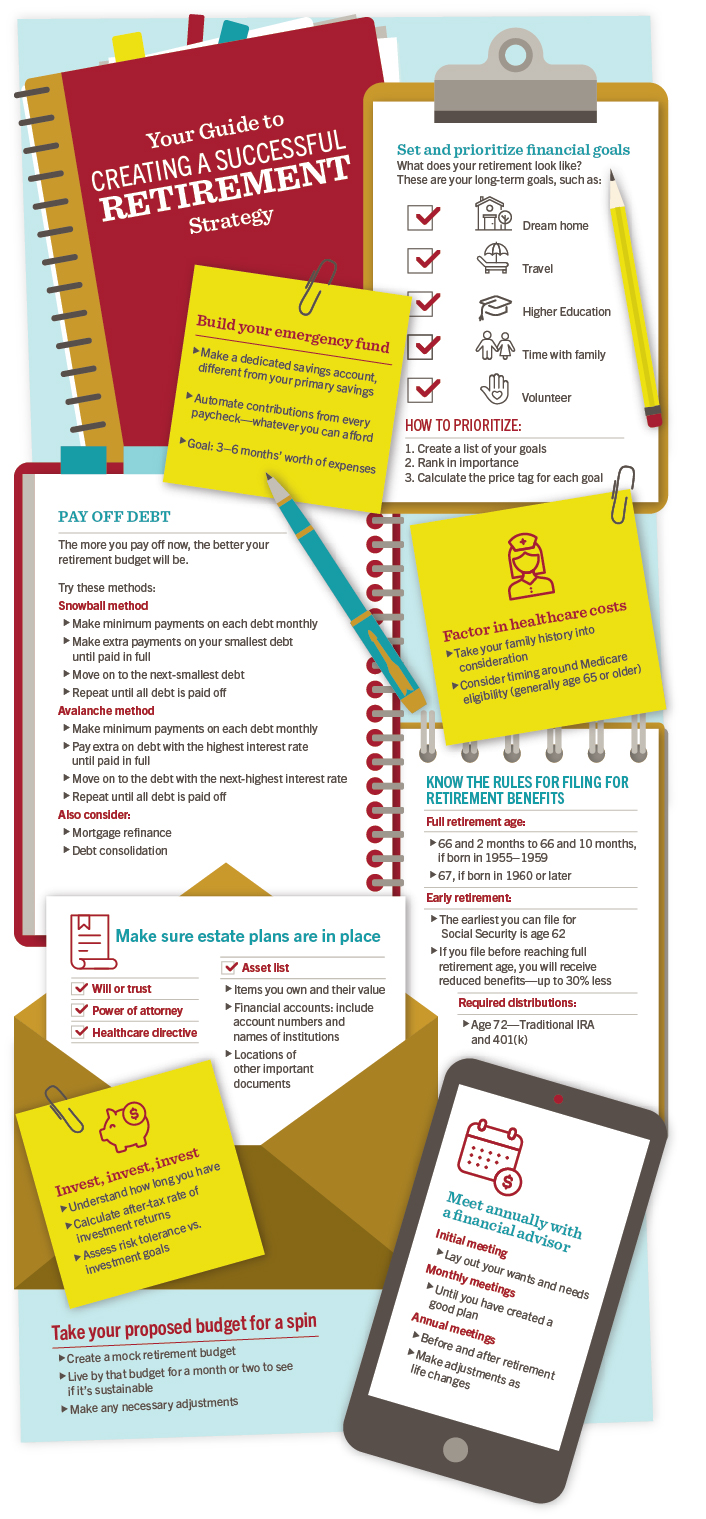

Whether you want to build a family home for future grandchildren, travel the world or pursue a new passion in your later years, here's your guide to creating a successful retirement strategy:

Set your life goals

First, you need to determine what your ideal retirement looks like. We know, setting goals can seem overwhelming, but it's incredibly useful in helping you plan for your financial future.

Start by asking yourself if you plan to:

-

Have kids. If so, how many?

-

Buy your dream home. Do you want to downsize or upsize? Or, if you're already in a dream home, do you want to renovate?

-

Travel. If yes, where do you want to go, and for how long? Will you stay in hotels or hostels? Will you drive or fly? Fly coach or first class?

-

Go back to school. Which school?

-

Send kids to college. How much will their future education cost?

This may seem exhaustive, but it will help you figure out what’s needed to support this dream retirement of yours. Planning gives you a better idea of how much you can save for retirement—and how much you'll need to support yourself once those expenses are covered.

Also, if you're a business owner, look into which business retirement plans are best for you and your staff.

Don't forget that emergency fund

An emergency fund is a must at all times, but especially during retirement when you live on a fixed income. Retirement savings can be the difference between you clocking out of work and traveling, or staying in the office for another five to 10 years.

Regardless of what you currently have in your 401(k), IRA or other retirement accounts, you need another nest egg set aside with at least three months' expenses saved.

Start by putting a small amount of cash—even just $25 or $50—into a savings account each month. Gradually increase that over time and you'll be shocked at how quickly it adds up, especially if you put it into a high yield savings account!

Get rid of debt

Add being debt-free before retirement to your plans, as well. No debt means more money to use on the things you enjoy. And the sooner you do it, the less you'll pay in interest.

Some people like to do this by starting with the smallest debts and rolling your payments into larger debts over time. Often called the “snowball” method, this is best for people who are encouraged by gradual change. Others prefer to tackle the debt with the highest interest rate first, so they pay less interest over time. Either method works, as long as you are dedicated and consistent in your payments.

To help get rid of that debt, contact us as Mountain America to talk about refinancing your mortgage and consolidating other debts.

Figure out when to retire and take social security and Medicare

The last step in creating your retirement strategy is determining at what age you'll want to retire. Choose wisely, because when you retire can affect which government benefits—like social security and Medicare—you can take.

Most people decide to leave the workforce between 62–66 years old, but the best way to pick your retirement age is to determine how much you need to save for retirement and how much you can save per year. If you don't think you can make it as early as you like, then you may want to talk to us about investment options like IRAs, money market accounts or a laddering strategy for certificate accounts.

Ultimately, determining how much to save for retirement is highly personal and crucial to determining which retirement strategies are best for you.

Need some more help with your retirement planning? Contact Mountain America at 1-800-748-4302 today.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Mountain America Credit Union and Mountain America Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Mountain America Investment Services, and may also be employees of Mountain America Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Mountain America Credit Union or Mountain America Investment Services. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed |

| Not Credit Union Deposits or Obligations | May Lose Value |

This site is designed for U.S. residents only. The services offered within this site are available exclusively through our U.S. Investment Representatives. LPL Financial U.S. Investment Representatives may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

Mountain America Credit Union (“Mountain America”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Mountain America for these referrals. This creates an incentive for Mountain America to make these referrals, resulting in a conflict of interest. Mountain America is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html.

LPL Financial Form CRS.

Related Articles