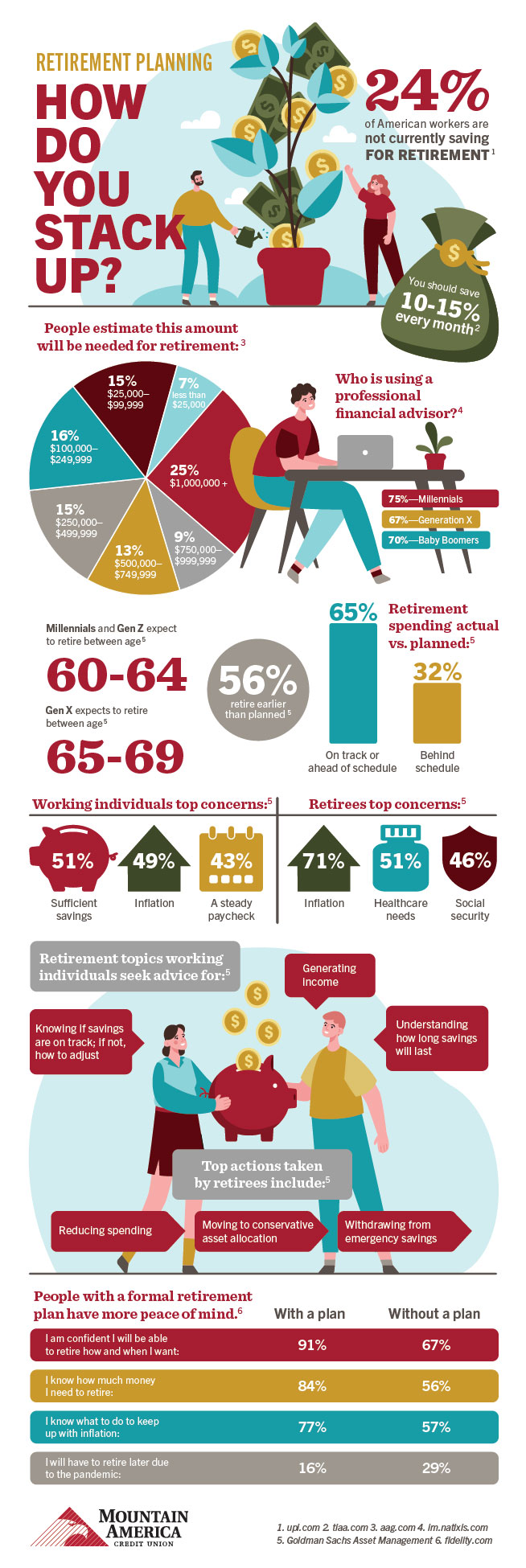

Retirement Planning: How Do You Stack Up?

Are you sure you're on the right track with your retirement savings? Take a look at these statistics to see how you stack up!

Whether retirement is right around the corner or still down the road a bit, it’s important to start planning as early as possible. This infographic highlights where many people stand when it comes to being prepared for the future.

What are your concerns?

For many, retirement brings images of travel, family outings and plenty of relaxing moments doing nothing—but it’s a good idea to plan for things like inflation and unexpected costs as well.

According to this recent survey, the top concerns of working individuals when it comes to retirement are having sufficient savings, inflation and leaving behind a steady paycheck. Not very surprising, those who have already retired are worried about the effects of inflation on their savings, healthcare needs and social security.

Should I work with a financial professional?

Needs change over time so make sure you are thinking about what could happen in the future. Meet with a financial advisor to uncover things you haven’t thought about and work these items into your plan before you’re caught off guard.

This isn’t something that is only for those close to retiring or those with a lot of wealth—anyone can benefit from meeting with an advisor. A recent report shared that 75% of Millennials, 67% of Gen X, and 70% of Baby Boomers use a professional financial advisor. This is a great resource to help you define your goals, outline the steps needed to reach them and give you options when life changes.

At what age do most people plan to retire?

You may have a date in mind for when you want to retire but, according to Goldman Sachs, 56% of retirees report retiring earlier than planned for reasons like health issues, job security and more.

No matter how much you plan, you are likely not to think of everything. That’s why it’s important to revisit your plan often. It’s no secret that many retirees (32%) are spending more than they expected.

Get more information about how you stack up when it comes to retirement planning in the full infographic above. Don’t forget to contact a retirement expert at Mountain America Investment Services to help you plan for your golden years!

1. upi.com

2. tiaa.com

3. aag.com

4. im.natixis.com

5. Goldman Sachs Asset Management

6. fidelity.com

Related Articles

How to Prep for a Better Retirement | Guiding You Forward