Do You Have a “Follow Your Dreams” Fund?

Don’t be afraid to follow your dreams! Learn how to get started with a financial safety net.

Our workplaces have experienced noticeable changes in the last few years as people are more determined to follow their professional dreams. Many people in office settings have decided to look for a better fit as companies have transitioned to hybrid or remote work options, and service-industry employees are searching for new opportunities with higher pay.

If you are among those seeking to work differently, work less or completely change careers, reaching your career goal will become much easier if you have an established financial safety net.

Position yourself to pursue your dreams by taking these steps:

Start or build emergency savings.

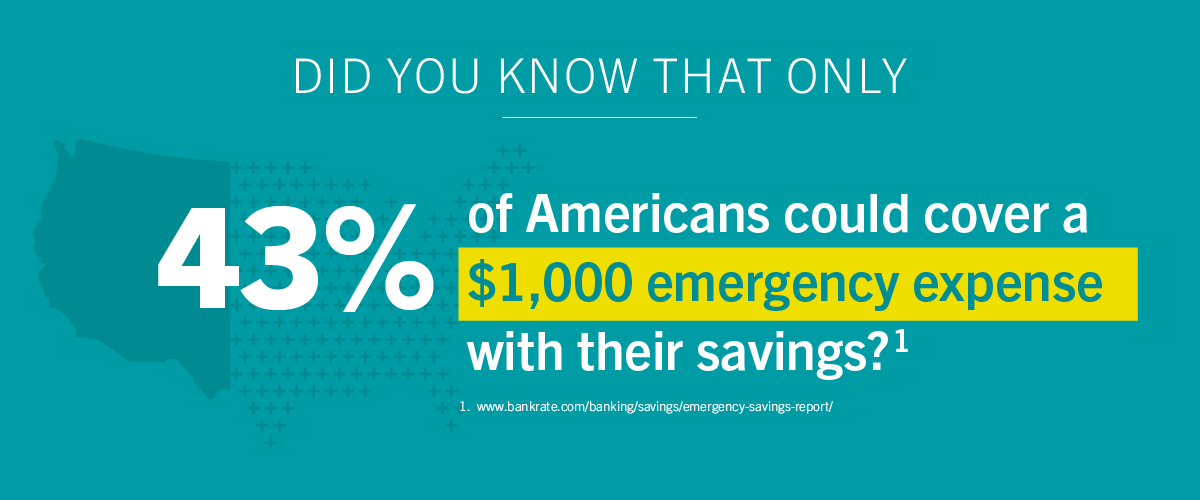

The bedrock of financial preparedness is an emergency savings account or a “follow your dreams” fund for personal or professional pursuits. This account is your cushion to cover unexpected expenses and keeps you on track toward achieving your long-term goals.

To start building a “follow your dreams” fund, open a secondary savings account that is used only for unforeseen costs—don’t mix that money with your regular savings. Then begin making regular deposits into that account. Start small if you need to. The key is to be consistent and work toward having enough savings to cover six months of expenses. If you need to tap into these savings—for example, to replace the furnace or repair your car—make sure to replenish those funds as soon as possible.

Open a certificate account (or two).

With the interest rate hikes to combat inflation in 2023, savings account interest rates steadily increased, helping people build their wealth faster and easier. Certificate accounts are an especially lucrative option right now.

With a certificate, you set aside a lump sum for a fixed period—anywhere from six months to five years. In return, you earn higher dividends than you would with a traditional savings account. There are even certificate options where you can start small and continue depositing funds throughout the certificate term. Certificates are low risk and provide a guaranteed outcome, which makes them ideal for riding out market volatility.

- Don’t procrastinate. The longer you wait, the harder it gets to achieve your goals. Act now while savings account rates are higher and momentum is on your side.

Mountain America is always here to help! Meet with one of our financial guides who can help you prepare to follow your dreams.

Related Articles

4 Tips to Keep Your Focus on Saving