EARN HIGHER DIVIDENDS

Certificate Accounts

Mountain America’s certificates are a great way to earn competitive dividends on safe, long-term investments.

Put your money to work

With a Mountain America certificate, you set aside funds for a set period of time—between 6 to 60 months. In return, you receive a higher dividend than with a primary savings account. It’s a simple way to boost your savings and prepare for your financial future.¹

Choose from several options, including standard, growth and Christmas Club certificates. Get more details below.

How to open a certificate account

Follow these steps to see your earnings grow.

Current members

New members

Current members

New members

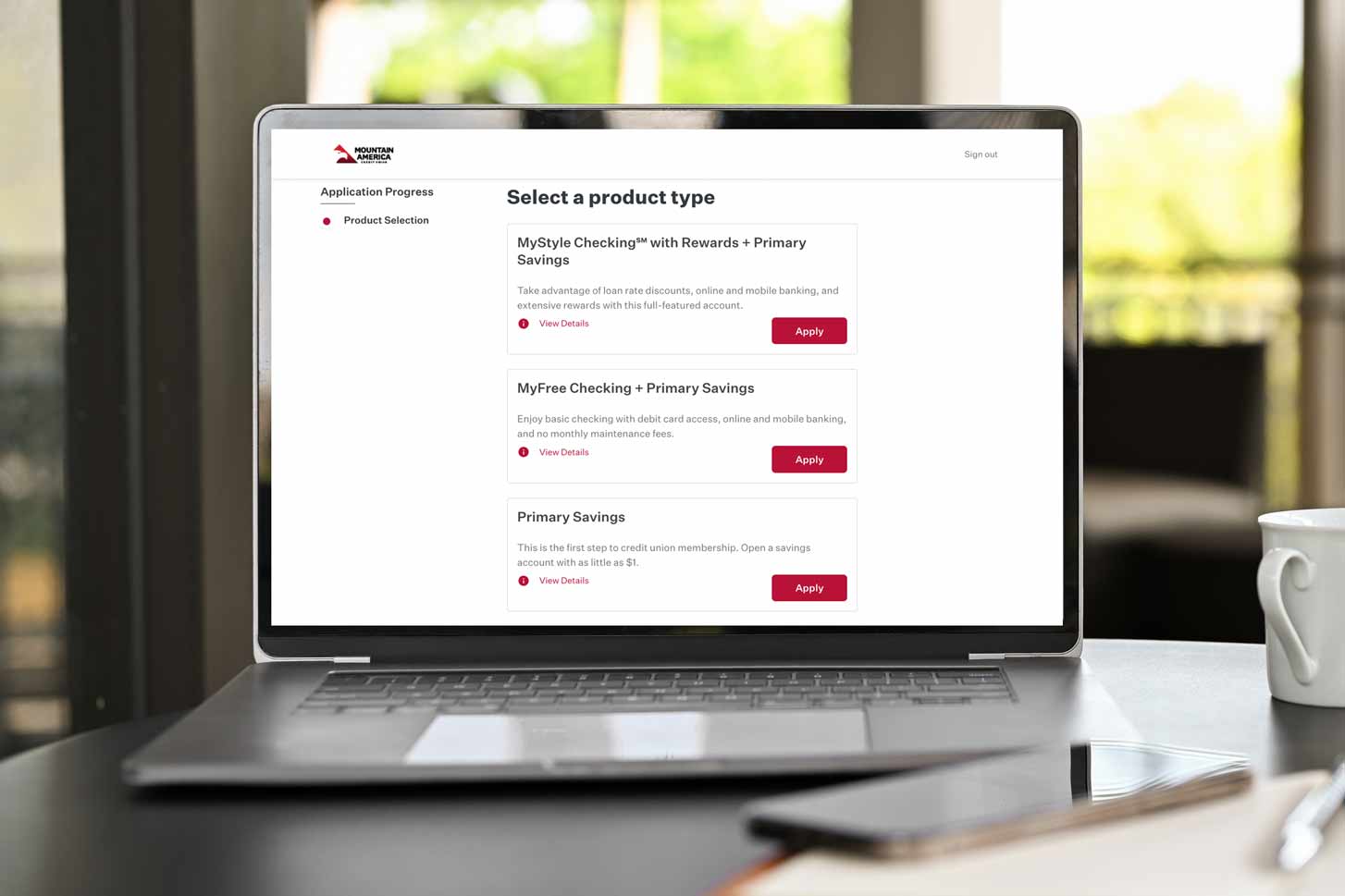

Step 1

Open an account online

Start by opening a savings account online.Open now

Or, get started at your nearest branch.

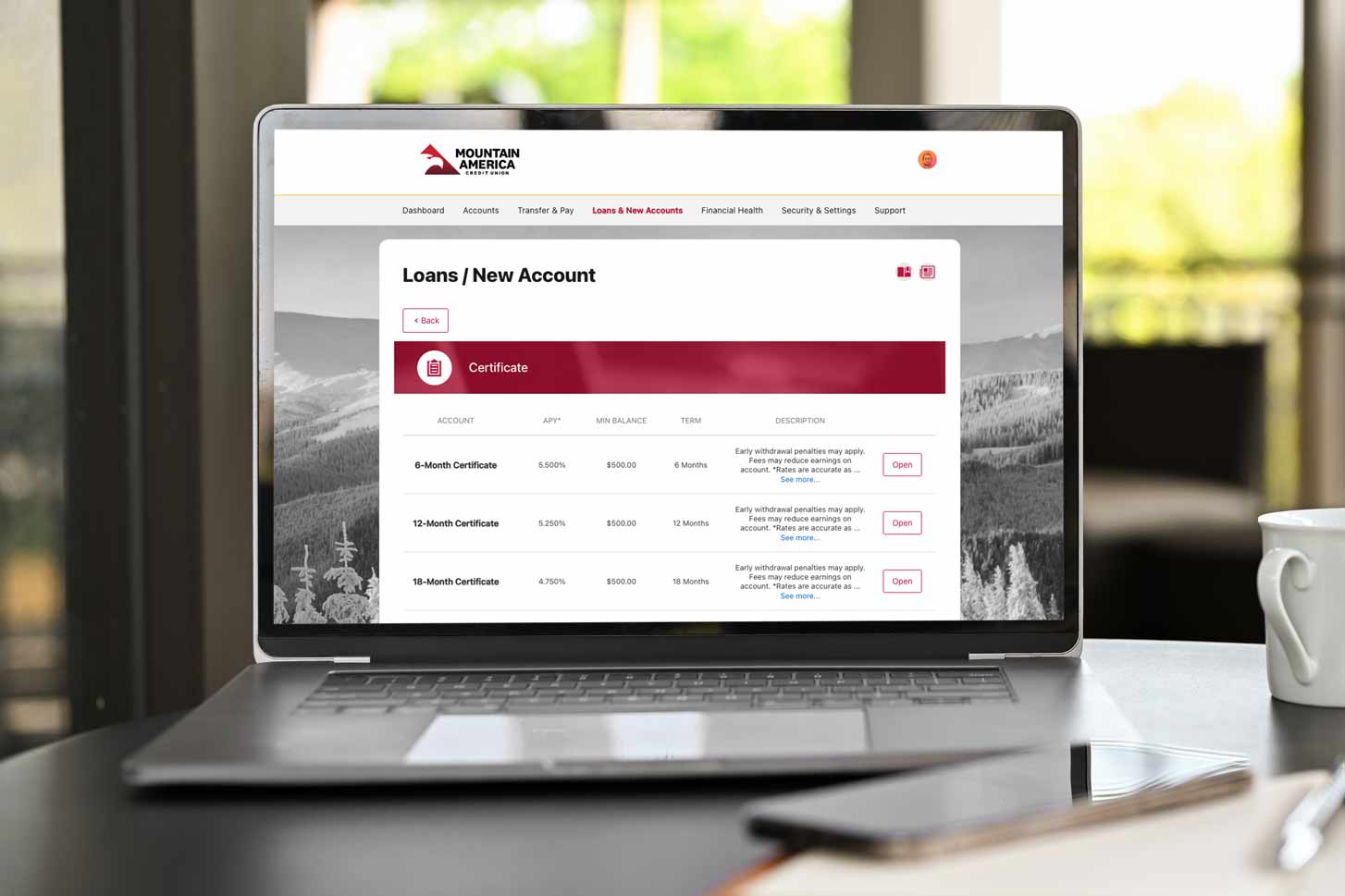

Step 2

Log in

Once your savings account is open and funded, simply log in at macu.com or on the mobile app, select Loans & New Accounts and then click New Savings or Certificate.Log in Log in

Choose a standard or growth certificate

Standard Certificate

- Requires $500 to open the account

- Rate bump options for standard and IRA certificates—bump up to a higher rate if one becomes available

What is a rate bump option?

A rate bump is a way to take advantage of a rising rate environment. You start with a slightly lower rate (0.25% below base), but in return, you have a one-time option to bump up the rate at a later date if the market changes. This gives you the potential to accrue higher dividend earnings.²

Growth Certificate

- Only $5 to open the account

- Funds can be added anytime

- Requires automated monthly deposit of at least $10

- No rate bump option

Is a growth certificate right for you?

Mountain America’s growth certificate account makes saving for long-term goals easy. That’s because you can start with as little as $5. And unlike standard certificates, you can add money anytime you want—up to a cumulative cap of $100,000.

Certificate rates

| Product | Standard $500 to open | Growth $5 to open | Youth $5 to open |

|---|---|---|---|

| 6-month | % (% APY) | % (% APY) | |

| 12-month | % (% APY) | % (% APY) | % (% APY) |

| 18-month | % (% APY) | % (% APY) | |

| 24-month | % (% APY) | % (% APY) | % (% APY) |

| 30-month | % (% APY) | % (% APY) | |

| 36-month | % (% APY) | % (% APY) | % (% APY) |

| 48-month | % (% APY) | % (% APY) | % (% APY) |

| 60-month | % (% APY) | % (% APY) | % (% APY) |

| Product | Dividend rate | Minimum balance | |

|---|---|---|---|

| Christmas Club Certificate Learn more | % (% APY) | $5 | |

| APY= Annual percentage yield. | |||

RATE BUMP FAQS

What accounts are eligible for a bump?

You may add a bump option to standard or IRA certificates at account opening or within 10 days of renewal. Growth, Christmas Club and youth certificates are not eligible.

What if rates never increase during the term?

Due to the unpredictability of the market, you may not have an opportunity to bump your rate.

What if I forget to bump up my rate?

Your rate will remain the same. Mountain America will not make changes to your certificate without your direction.

Will my bump certificate automatically renew as a bump certificate or a standard certificate at maturity?

When the certificate reaches maturity, the account will renew as a standard certificate. Adding the bump option will reduce the current rate by 0.25%. Mountain America will not reduce your rate unless you instruct us to do so.

Learn more about certificates

What Is Laddering?

Keep your funds accessible by staggering the maturity dates of your certificates.

Additional resources

Benefits of Certificate Accounts

Explore what a certificate account is and the compelling reasons why it should be part of your savings strategy.

Money Market vs. Certificate Accounts

Delve into the differences between money market and certificate accounts to choose the right one for your savings.

Get to Know Our Growth Certificate Account

Discover our Growth Certificate Account and how it can accelerate your savings goals effectively.

1. Annual percentage yield is accurate as of . $500 minimum balance required to open and maintain standard, IRA and Roth IRA certificates. $5 minimum balance required to open and maintain growth certificates. Growth certificates are limited to $100,000 on deposit in any one, or combination of, growth certificate accounts per primary accountholder. Growth certificates require an automated monthly deposit of at least $10. Upon meeting the $100,000 aggregate deposit limit, automated monthly deposits may be canceled by the credit union and no additional deposits will be allowed in any growth certificate for that member. Penalty for early withdrawal. Fees may reduce earnings. Offer not available for financial institutions or other institutional investors. Rate cannot be applied to previously opened certificates unless utilizing an existing one-time bump option. Limited-time offer. Any offer provided by Mountain America can be withdrawn at any time and is subject to change.

2. Rate increase (bump) must be initiated by the member during the term of the certificate. Mountain America will not automatically increase the rate on the account and is not responsible for notifying members of rate fluctuations. Bump option can be done only once during the term. Bump option pertains to the prevailing Mountain America certificate rate and will be in effect for the remainder of the term only. The new interest rate will not be applied retroactively.