How Imposter Fraud Works

Quick Summary

Fraud is on the rise! And many of the scams we see are imposter fraud. Essentially, this is when a criminal pretends to be someone else to gain access to your money.

There are all types of imposter fraud—romance scams, bank fraud, IRS scams, emergency scams, wire fraud and many more. The key to preventing fraud is to understand how it works. Sometimes, that can be difficult because the scam is a little complicated to follow.

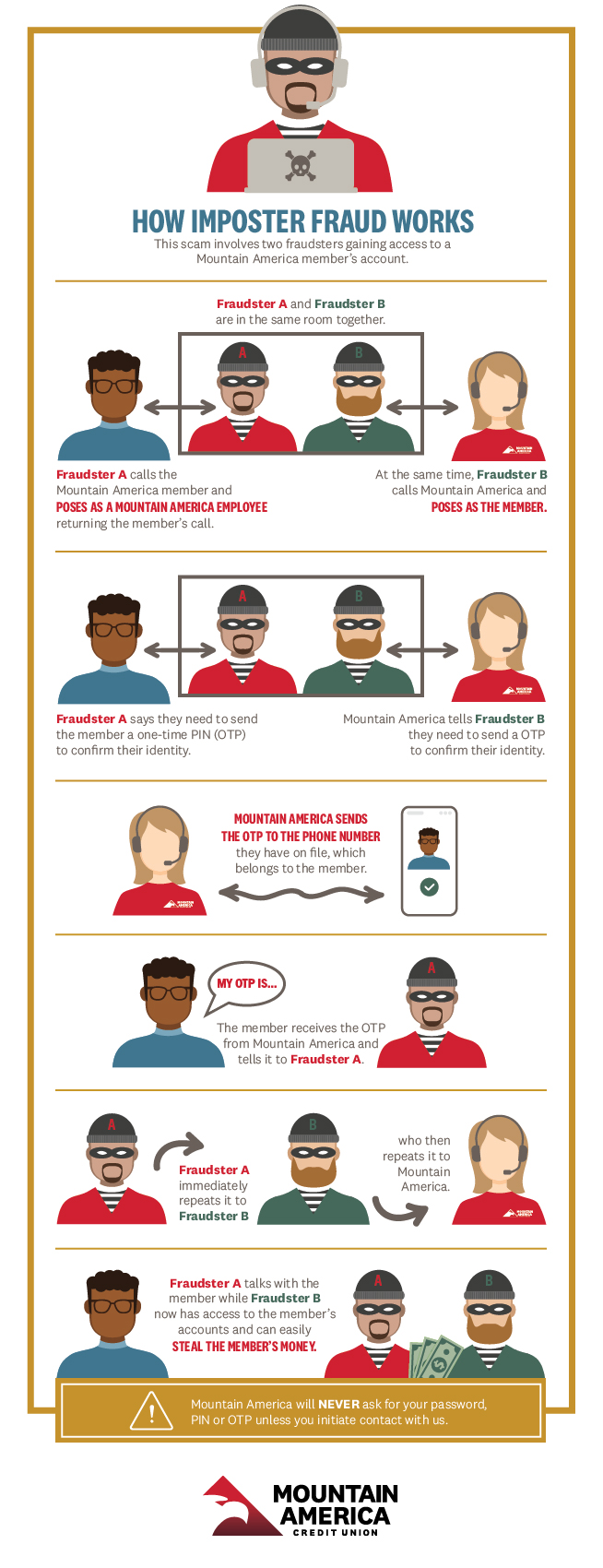

Here’s an infographic from Mountain America Credit Union that can help clear it up. This one is based on a credit union member being contacted by someone pretending to be an employee of their credit union. It shows how easily an unauthorized person can access your accounts if you’re not aware of the warning signs.

Remember: Mountain America will never ask for personal information like your password, PIN or one-time PIN unless you initiate contact with us.

Mountain America’s commitment is to make sure we are talking to the account holder. However, if you have been contacted out of the blue by your financial institution and they are asking for personal information like this, be very wary. The best course of action in a situation like this is to hang up and call the bank or credit union on the phone number listed on their website (not one contained in a text or email).

How Imposter Fraud Works

This scam involves two fraudsters gaining access to a Mountain America member’s account.

- Fraudster A and Fraudster B are in the same room together.

- Fraudster A calls the Mountain America member and poses as a Mountain America employee returning the member’s call.

- At the same time, Fraudster B calls Mountain America and poses as the member.

- Fraudster A says they need to send the member a one-time PIN (OTP) to confirm their identity.

- Mountain America tells Fraudster B they need to send a OTP to confirm their identity.

- Mountain America sends the OTP to the phone number they have on file, which belongs to the member.

- The member received the OTP from Mountain America and tells it to Fraudster A.

- Fraudster A immediately repeats it to Fraudster B, who then repeats it to Mountain America.

- Fraudster A talks with the member while Fraudster B now has access to the member’s accounts and can easily steal the member’s money.